Top Cloud and Communications Subscription Service Metrics and KPIs

Service metrics and KPIs for cloud and communication service providers can be difficult to establish (what is calculated and how) and implement (source data retrieval, consolidation).

For the most part, challenges lie in reporting changes to subscriptions (re-rates, replacements) as well as multiple systems involved (CRM, order management, billing).

Quote-to-Cash (QTC or Q2C) implementations are a good opportunity to improve business reporting — not only their implementation, but also (more importantly) review what KPIs and metrics are reported, and how they are calculated.

This post describes best practices metrics implemented by Nextian Reporting & Analytics.

Challenges

The key challenges are variations in formulas (there are no “standard” formulas) and terminology, as multiple terms are used (often even within a single organization), for example:

revenue contraction = revenue compression = revenue down-tick

What to report?

Recurring revenue is by far the most important metric for service providers.

Since most services are invoiced monthly, Monthly Recurring Revenue (MRR) is particularly important.

While this post focuses on revenue reporting, it is relatively easy apply similar reporting structure to other KPIs such as profit or margin. At Nextian we recommend building service reports following income statement structure: revenue, cost, gross profit/margin, sales cost (commissions) and net profit/margin.

Reporting periods

Since most services are billed monthly, operational reports are usually monthly or MTD (month-to-date). Other popular periods include quarterly, yearly, and YTD (year-to-date).

Top subscription service KPIs and metrics

| KPI | Description |

|---|---|

| Current Total MRR | Total MRR for all active (billed) services at the beginning of the reporting period. |

| Booked Orders | This is what the sales organization quoted and closed, i.e., received a PO signature from a customer or some other form of obligation that order has been placed. |

| Canceled Orders | Orders that were cancelled, before ordered services went into service, i.e., became operational. Order cancellations allowed in certain businesses (e.g., telecommunication services). |

| New Sales | New services for brand new customers (a.k.a. new logo sales). |

| Cross-Sales | Additional, new services purchased by existing customers, e.g.:

|

| Up-Sales / Uptick | Add-ons or upgrades to existing services resulting in revenue increase, e.g.:

|

| Down-Sales / Downtick | Downgrades or re-rates to existing services resulting in revenue decrease, e.g.:

|

| Canceled Services | Services that are fully cancelled by customers (in telecommunications space, these are often referred to as “disconnected” services). |

| New MRR | New Sales + Up-Sales + Cross-Sales |

| Lost MRR | Canceled Services + Downtick |

| Net MRR | New MRR – Lost MRR |

| Churn % | Lost Revenue / Current Total MRR |

| Compression / Contraction % | Down-Sales / Current Total MRR |

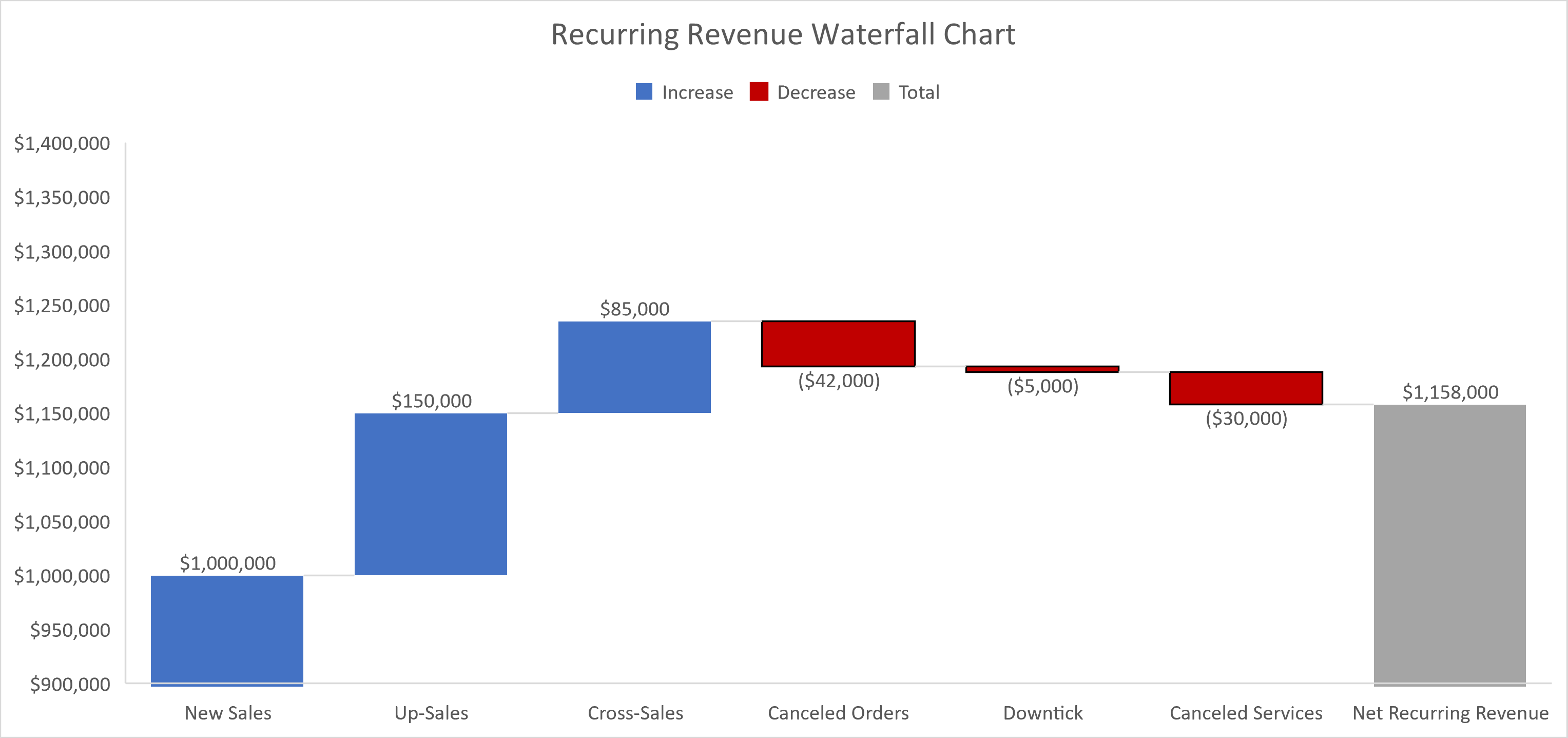

These are best visualized as waterfall charts:

Example

First, we need to know the MRR at the beginning of the reporting period. To make calculations easy we will only use five services:

| SERVICE | MRR |

|---|---|

| SERVICE‑1 | $120.00 |

| SERVICE‑2 | $130.00 |

| SERVICE‑3 | $150.00 |

| SERVICE‑4 | $150.00 |

| SERVICE‑5 | $150.00 |

| Total Monthly MRR | $700.00 |

Let’s assume that the following orders have been received during the month (accounting notation used for negative numbers):

| Order # | Order Type | Service | Customer | Current MRR | New MRR | Net MRR |

|---|---|---|---|---|---|---|

| 1 | New | SERVICE‑6 | New | – | $150.00 | $150.00 |

| 2 | New | SERVICE‑7 | Existing | – | $180.00 | $180.00 |

| 3 | New | SERVICE‑8 | Existing | – | $170.00 | $170.00 |

| 4 | Order Canceled | SERVICE‑8 | Existing | $170.00 | – | ($170.00) |

| 5 | Cancel Service | SERVICE‑5 | Existing | – | ($150.00) | ($150.00) |

| 6 | Re-term (customer agreed to a longer term for a reduced monthly rate) | SERVICE‑4 | Existing | $150 | $140.00 | ($10.00) |

| 7 | Change (additional component added to the service) | SERVICE‑3 | Existing | $150 | $170.00 | $20.00 |

Depending on how order cancellations are handled [3] and [4] may be represented as a single, canceled order. At Nextian we recommend separating each transaction into an “order” (i.e., a separate request from the customer) and that is how we represented it in the example.

Service vs. order cancellation

This differentiation seems to cause a lot of confusion as these terms seem to be used almost interchangeably in certain businesses, however they mean two very distinct things:

- Order cancellation is a withdrawal of a previously issued order (no matter what that order is)

- Service cancellation causes termination of an existing service that is live (“in service”) at the time that service cancellation order has been issued by the customer

The monthly metrics are as follows (order numbers from the table above are referenced with square brackets []):

| KPI | Value | Calculation |

|---|---|---|

| Booked Orders | $520.00 | [1] + [2] + [3] + [7] |

| Canceled Orders | ($170.00) | [4] |

| New Sales | $180.00 | [1] (the only order that is for new customer) |

| Cross-Sales | $150.00 | [2] (order [3] excluded because it had been canceled) |

| Up-Sales | $20.00 | [7] |

| Down-Sales | ($10.00) | [6] |

| Canceled Services | ($150.00) | [5] |

| New MRR | $370.00 | [1] + [2] + [7] |

| Lost MRR | ($160.00) | [5] + [6] |

| Net MRR | $190.00 | New MRR – Lost MRR (from two rows above) |

| Churn | 22.86% | $160.00 (Lost MRR) / $700.00 (revenue at the beginning of the reporting period) |

| Compression / Contraction | 1.43% | $10.00 (Down-Sales) / $700.00 (revenue at the beginning of the reporting period) |

Conclusions

The calculations above are just a starting point. There might be other KPIs or different methods of measurement, specific to a particular business. Additional analysis may be added with per product / service type drill down, including cancellations in churn, pending service cancellations or various billing cycles.

At Nextian we recommend the following practices:

- Make sure to capture all basic data points first — when a good foundation has been established, it’s easy to build even most complex reports,

- Begin with a minimum viable report set and take it from there,

- Build examples in Microsoft Excel and review with stakeholders before implementing — when naming and formulas are agreed upon, implementation in reporting tools is much easier.

Nextian is a vendor of Quote-to-Cash (QTC) software for cloud and communications helping providers accelerate growth and increase customer lifetime value.

Contact us today to find out how we can help you!